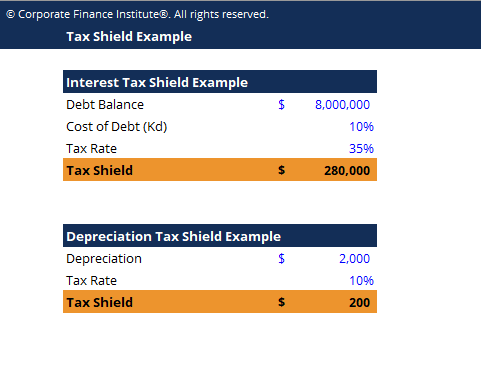

interest tax shield example

The value can be calculated by the interest expense multiplied by the companys tax rate. To learn more launch.

The Interest Tax Shield Explained On One Page Marco Houweling

Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG.

. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. Is considering a proposal to acquire a machine costing 110000 payable 10000 down and balance payable in 10 equal installments at the. Interest Tax Shield Interest Expense Deduction x.

Basically the company uses two main tax shield strategies. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a. Interest Tax Shield Calculation Example ABC Ltd.

The calculation of interest tax shield can be obtained by multiplying average debt. Interest Tax Shield Interest expense Tax Rate. Suppose company X owes 20m of taxes pays 5m.

Interest Tax Shield Example. Is considering a proposal to acquire a machine costing 110000 payable 10000 down and balance payable in 10 equal installments at the. Tax Shield Deduction x Tax Rate.

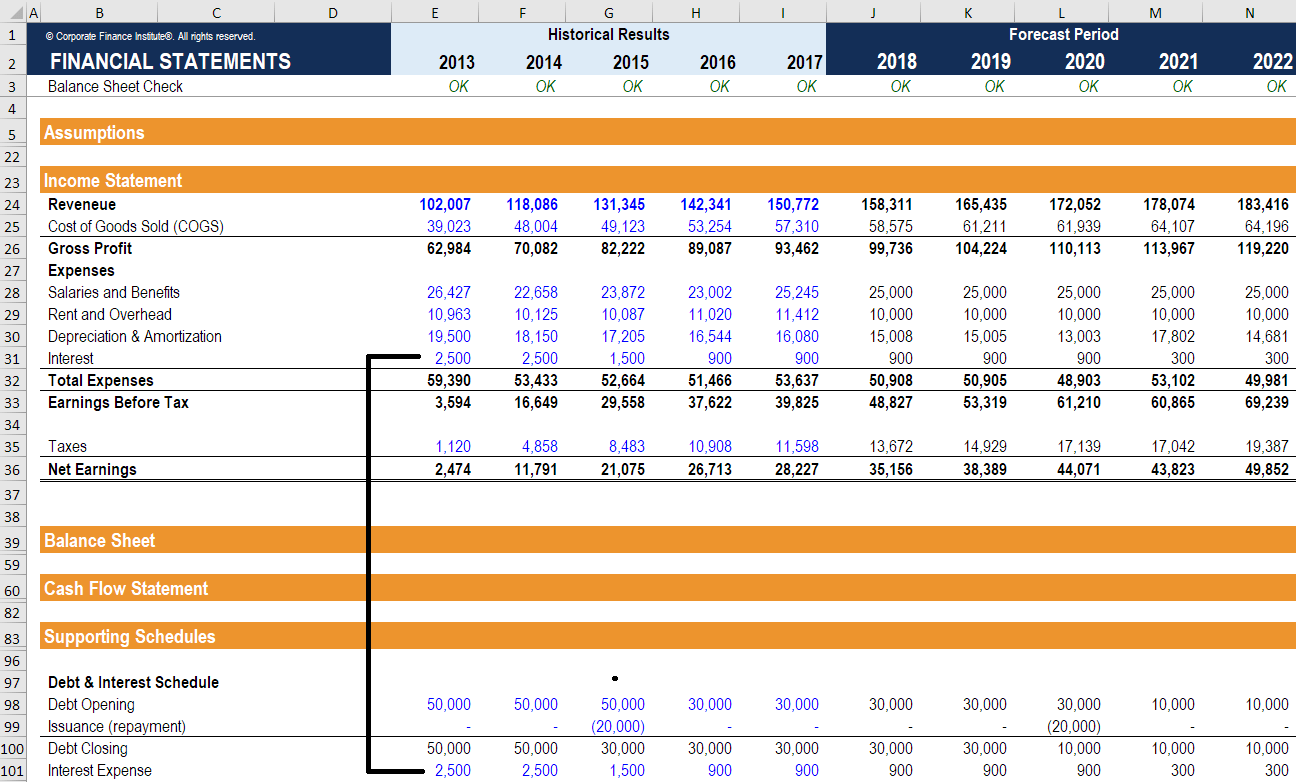

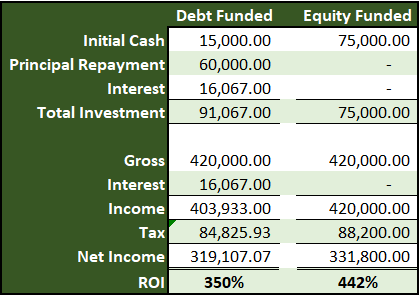

Therefore XYZ Ltd enjoyed a Tax shield of 12000 during FY2018. The effect of a tax shield can be determined using a formula. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

Interest Tax Shield Calculation Example ABC Ltd. This is usually the deduction multiplied by the tax rate. Suppose there are 2 identical companies A and B.

That is the interest expense paid by a company can be subject to tax deductions. Many middle-class homeowners opt to deduct their mortgage expenses thus shielding some of their income from. Tax_shield Interest Tax_rate.

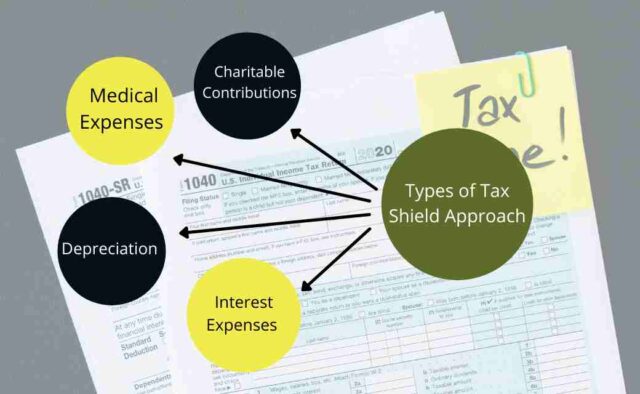

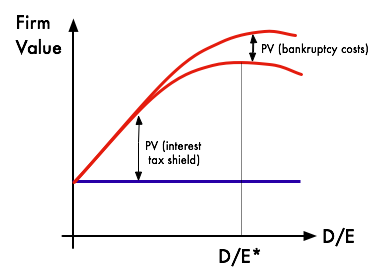

To calculate the value of the interest tax shield you may use this interest tax shield calculator or estimate the value manually as we. Examples of tax shields include deductions for charitable contributions mortgage. The impact of adding removing a tax.

Interest Tax Shield Example. This companys tax savings is equivalent to the interest payment. The value of these shields depends on the effective tax rate for the corporation or.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. This tax shield example template shows how interest tax shield and depreciated tax shield are calculated. Both companies are identical in all aspects other than debt.

For example year 15s interest tax shield is fixed once debt is rebalanced in year 14. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Lets consider a very simple example.

Let us take the example. Such a deductibility in tax is known as. A companys interest payments are tax deductible.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. A Tax Shield is an allowable deduction from taxable income that. Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate.

Tax shields do not only benefit the wealthy however.

Interest Tax Shield Formula And Calculator Step By Step

Interest Expense How To Calculate Interest With An Example

Tax Shield Example Template Download Free Excel Template

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Tax Shield Formula Step By Step Calculation With Examples

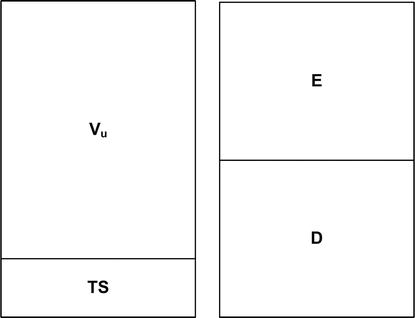

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Fin 300 Financial Modelling More Debt Vs Interest Rate Tax Shield Ryerson University Youtube

Depreciation Tax Shield Formula Examples How To Calculate

Chapter 15 Debt And Taxes Ppt Download

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance

How Tax Shields Work For Small Businesses In 2022

Trade Off Theory Of Capital Structure Wikipedia

Apv Formula And Calculator Step By Step

In This First Example The Tax Shield Is Calculated Chegg Com